Trust Foundations: Dependable Solutions for Your Construction

Strengthen Your Legacy With Professional Trust Fund Foundation Solutions

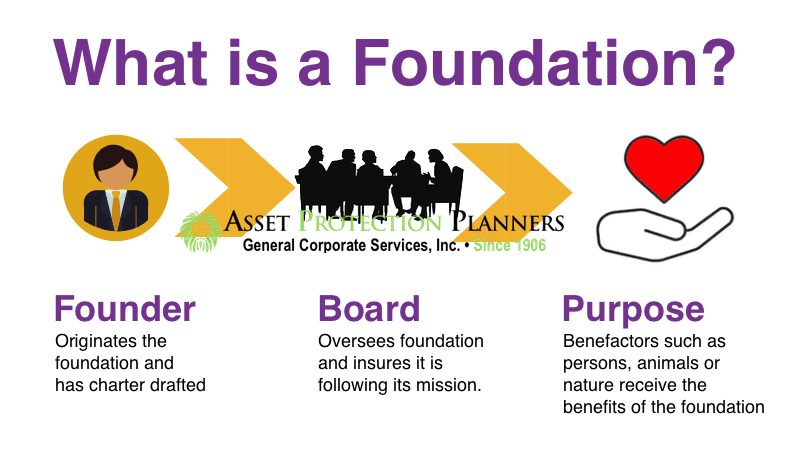

In the realm of tradition preparation, the relevance of developing a strong foundation can not be overstated. Professional count on foundation options provide a robust structure that can secure your possessions and guarantee your wishes are performed specifically as planned. From reducing tax liabilities to picking a trustee who can properly manage your events, there are critical considerations that require attention. The intricacies associated with depend on frameworks necessitate a strategic approach that aligns with your long-lasting objectives and values (trust foundations). As we explore the subtleties of depend on foundation solutions, we reveal the essential aspects that can fortify your heritage and give a long lasting influence for generations ahead.

Benefits of Count On Foundation Solutions

Trust fund foundation solutions use a durable framework for safeguarding assets and guaranteeing long-term monetary protection for people and companies alike. One of the key advantages of trust fund foundation options is possession defense.

In addition, depend on structure remedies provide a critical strategy to estate preparation. Via depends on, individuals can detail just how their assets must be managed and dispersed upon their death. This not only assists to avoid disputes among beneficiaries yet also makes certain that the individual's tradition is maintained and managed successfully. Depends on additionally offer personal privacy advantages, as properties held within a trust are exempt to probate, which is a public and often prolonged lawful procedure.

Kinds Of Trusts for Heritage Planning

When thinking about tradition planning, an important facet involves exploring various kinds of legal tools developed to maintain and disperse properties effectively. One typical sort of trust fund used in legacy preparation is a revocable living count on. This count on allows individuals to maintain control over their properties throughout their life time while making sure a smooth shift of these assets to recipients upon their passing, avoiding the probate procedure and offering personal privacy to the household.

Another type is an irrevocable trust fund, which can not be altered or withdrawed when established. This depend on provides prospective tax benefits and shields assets from financial institutions. Philanthropic trusts are likewise popular for people seeking to sustain a reason while keeping a stream of earnings for themselves or their beneficiaries. Special demands depends on are important for people with handicaps to ensure they get necessary care and assistance without endangering government benefits.

Recognizing the various types of trusts available for legacy planning is crucial in developing a thorough approach that straightens with private goals and concerns.

Picking the Right Trustee

In the world of tradition preparation, a crucial element that requires careful factor to consider is the option of an ideal individual to fulfill the crucial role of trustee. Picking the best trustee is a choice that can dramatically influence the successful implementation of a trust fund and the gratification of the grantor's dreams. When picking a trustee, it is vital to focus on qualities such as dependability, economic acumen, honesty, and a commitment to acting in the most effective passions of the recipients.

Ideally, the picked trustee should possess a strong understanding of financial issues, be capable of making sound financial investment decisions, and have the capacity to browse intricate lawful and tax obligation requirements. By thoroughly thinking about these elements and picking a trustee who aligns with the values and objectives of the read the full info here trust fund, you can aid guarantee the long-term success and conservation of your heritage.

Tax Ramifications and Benefits

Thinking about the monetary landscape surrounding count on structures and estate planning, it is vital to dive right into the intricate world of tax obligation implications and advantages - trust foundations. When developing a trust, comprehending the tax obligation ramifications is essential for optimizing the advantages and reducing prospective obligations. Trust funds use numerous tax obligation benefits depending upon their framework and purpose, such as lowering estate taxes, earnings tax obligations, and present taxes

One substantial benefit of particular trust fund structures is the capacity to move assets to beneficiaries with minimized tax effects. For instance, irreversible trusts can eliminate properties from the grantor's estate, possibly lowering inheritance tax responsibility. Furthermore, some trust funds enable income to be distributed to recipients, that may be in lower tax brackets, resulting in general tax obligation savings for the family.

Nonetheless, it is crucial to note that tax regulations are complicated and conditional, highlighting the requirement of talking to tax specialists and estate preparation professionals to make certain conformity and maximize the tax advantages of count on foundations. Effectively browsing the tax obligation effects of trusts can bring about substantial savings and an extra effective transfer of wealth to future generations.

Steps to Developing a Trust

The very first step in establishing a trust is to clearly define the objective of the depend on and the properties that will be included. Next, it is critical to choose try this website the kind of count on that finest lines up with your objectives, whether it be a revocable count on, irreversible count on, or living trust fund.

Verdict

Finally, establishing a count on structure can give many advantages for legacy preparation, consisting of property security, control over distribution, browse around this web-site and tax advantages. By selecting the suitable sort of trust and trustee, individuals can safeguard their properties and guarantee their dreams are executed according to their desires. Understanding the tax ramifications and taking the needed actions to establish a trust can aid strengthen your tradition for future generations.